Investment risk management allows you to identify potential downsides and risks in an investment decision. Once you identify these factors, it is your decision whether to take these risks or mitigate them with proactive strategies. Risk factors can change over time, making the risk management a continuous process. You must be smart enough to understand the connection between risk and reward for your investment. It will help you make a better decision and invest your funds in the right area.

Mitigating investment risk will yield positive results like a higher return on investment (ROI). However, making these technical decisions on your own can be complicated. It is necessary to hire reputed asset management companies in Dubai and let them help you make an informed investment decision.

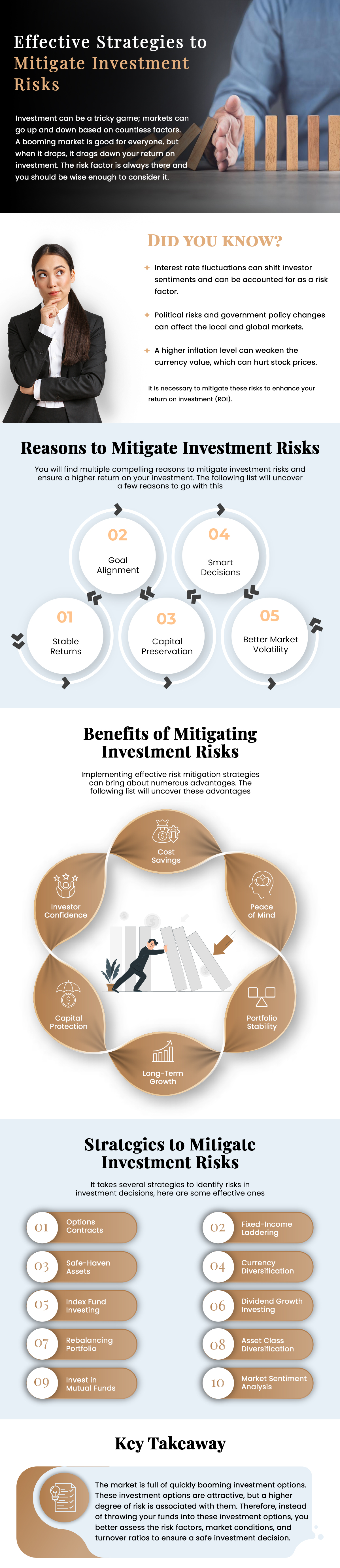

Investment can be a tricky game; markets can go up and down based on countless factors. A booming market is good for everyone, but when it drops, it drags down your return on investment. The risk factor is always there and you should be wise enough to consider it.

Did you know?

- Interest rate fluctuations can shift investor sentiments and can be accounted for as a risk factor.

- Political risks and government policy changes can affect the local and global markets.

- A higher inflation level can weaken the currency value, which can hurt stock prices.

It is necessary to mitigate these risks to enhance your return on investment (ROI).

Reasons to mitigate investment risks:

You will find multiple compelling reasons to mitigate investment risks and ensure a higher return on your investment. The following list will uncover a few reasons to go with this:

- Protection against market volatility

- Capital preservation

- Enhanced decision-making

- Stable returns

- Goal alignment

Benefits of mitigating investment risks:

Implementing effective risk mitigation strategies can bring about numerous advantages. The following list will uncover these advantages:

- Cost savings

- Enhanced long-term growth potential

- Capital protection

- Improved portfolio stability

- Increased investor confidence

- Peace of mind

Strategies to mitigate investment risks:

It takes several strategies and a critical mindset to identify potential downsides and risks in an investment decision. You can take several measures to mitigate these risks. Here are a few effective strategies that might help:

- Asset class diversification

- Currency diversification

- Options contracts

- Safe-Haven assets

- Rebalancing portfolio

- Fixed-income laddering

- Market sentiment analysis

- Invest in mutual funds

- Index fund investing

- Dividend growth investing

Key Takeaway:

The market is full of quickly booming investment options. These investment options are attractive, but a higher degree of risk is associated with them. Therefore, instead of throwing your funds into these investment options, you better assess the risk factors, market conditions, and turnover ratios to ensure a safe investment decision.

Leave a comment